- The Orca Fin

- Posts

- Domino Effect

Domino Effect

A glitch in the matrix?

Lots of action and daily headlines on the geopolitical and macro front. Tariffs go into effect for most of the world next week, and then there is all the speculation around rate cuts in September after Powell’s speech at Jackson Hole. On the tariffs front, I have spent much ink, and I will leave the rate cut subject to economists to debate. However, there is something that I am looking forward to with my popcorn ready: the end of the de minimis tariff rules.

The de minimis tariff rules exempted packages containing goods worth less than $800 from tariffs. All those trinkets and small, beautiful, cheap stuff will no longer be exempt from tariffs starting August 29. Haven’t seen much noise about it yet; however, almost all major postal carriers worldwide have temporarily suspended postal services to the US since US Customs has not provided guidance and detailed information about what exactly is going into effect. That hits the majority of us, simps. The circus on social media would be something to behold as people see the prices go up on those small items.

Talking about value for money, let’s talk about Domino’s Pizza (DPZ) today.

A decade and a half ago, DPZ was struggling. It needed a quick turnaround. What they did was a masterclass in marketing and operational execution. First, DPZ identified what needed to be fixed and got its house in order. Then, they went on a marketing blitz, accepting that their food sucked and that they were going to deliver value for money and quality of service. It may surprise many; DPZ has outperformed Google since then.

Note

There have been several companies that have gotten their marketing wrong, damaging their brands and negatively impacting their business in recent years. One doesn't need an MBA; reading the following classics will teach you what to do and what not to do. Also, these books will help in your investing journey.

Positioning by Al Ries and Jack Trout

The 22 Immutable Laws of Marketing by Al Ries and Jack Trout

The 22 Immutable Laws of Branding by Al Ries and Laura Ries

The QSR space, as a whole, has had a tough year. In the pizza space, apart from DPZ, everybody else is reporting flat to negative growth. The operational model and strength of DPZ have allowed it to gain market share and deliver same-store sales growth of 3.4% in Q2. DPZ’s US retail sales grew 5.1% and international sales grew by 6%, excluding the impact of foreign currency, in Q2.

A few things set DPZ apart from its competitors:

Entrepreneurial culture: Most of its franchise owners either started off as drivers or as managers at its stores and then went on to become franchisees.

Efficient corporate-managed centralized supply chain for North America.

Excellent international master franchisees.

Well-oiled delivery ecosystem.

To help maintain the growth momentum into 2026, DPZ has taken a few steps.

Partnership with UBER Eats.

Partnership with DoorDash went live end of Q2. DoorDash has twice the market share of UBER Eats in the pizza space.

Menu innovations like New York Style pizza and Parmesan-stuffed-crust pizza.

Given all this, DPZ has maintained its guidance of US comp for the year to be 3% and international same-store sales growth to be 1% to 2%. DPZ also expects operating income growth of 8% for the full year 2025.

All good. Let’s take a look at the financial statements to see if there are any minefields there.

DPZ Financial Statements Highlights

DPZ uses Whole Business Securitization (WBS), as is common in the QSR space. I had explained the mechanics of WBS in my recent article on WING; hence, I will not regurgitate it here. One of the features of using WBS is that a large long-term debt number shows up in the balance sheet. Now, when a portion of that becomes due in a year, that amount moves to the current liabilities section as “current portion of long-term debt”. What that does is it skews the current ratio.

Note

Current Ratio = Current Assets ÷ Current Liabilities

If the Current Ratio is less than 1, investigate the reason, as there is a possibility the company might not be able to meet its short-term obligations.

The current ratio for DPZ is 0.6. On the surface, that would be scary; however, in Q4 2024, $1.15 billion in debt became current as it is due in October 2025. DPZ expects to refinance the debt before the repayment date.

The Company expects to refinance the 2018 7.5-Year Notes and the 2015 Ten-Year Notes prior to the anticipated repayment date. If the Company does not refinance the 2018 7.5-Year Notes and the 2015 Ten-Year Notes prior to the anticipated repayment date, additional interest of at least 5% per annum will accrue and the Company’s cash flows other than technology fees and a weekly management fee to cover certain general and administrative expenses would be directed to the repayment of the securitized debt.

Source: Q2 2025 10Q PDF Page 13

Shouldn’t be an issue. Moving on to the recent quarterly income statements highlights.

DPZ - Quarterly Income Statements Highlights

Margins are all good and steady; they even improved in Q2 2025. As most of DPZ’s revenues come from franchisee royalties and fees, the COGS is mostly impacted by its supply chain segment and company-owned stores. Hence, the gross margin can swing based on how franchisee sales are performing.

Now, the fun part: I have to explain why I went crazy with my crayons, no? Consider the following:

… our sales are not typically seasonal …

Source: Source: Q2 2025 10Q PDF Page 25

See the spike in revenue in Q4 2024 (Dec-24 column)? Then see the sequential revenue change percentage. Some wild fluctuations there. Now, if one were to look at the EPS trend in 2024, it seems EPS is not seasonal; however, the statement in the 10Q mentions sales. Seems seasonal to me.

Now, consider the following statement made during the Q2 earnings call. While the discussion was around gross margins, something doesn’t square here.

And, yes, there's some seasonality based on what cost structures look like in the summer months, for example, where utility costs end up going up a little bit.

In any event, I am just highlighting what I found and not alleging anything untoward. Make what you will of it. Assuming there is no seasonality, there is a deterioration in EPS, which should be concerning. Now, let me highlight something that should really be concerning for DPZ over the next few quarters.

Verdict

In recent weeks, the relationship between the US and India has deteriorated markedly. Not so much due to the 50% tariffs; however, due to some untoward statements from the administration, which have not gone down well with the general public in India and the Indian government, for that matter. How bad is the current sentiment?

Now, this is X; however, as per his profile, he is: “Leading Asia expert experienced across government, markets, and think tanks. Advisor to two Secretaries of State, a former Treasury Secretary, and global CEOs.” Also, what Evan has said has been echoed by many other people.

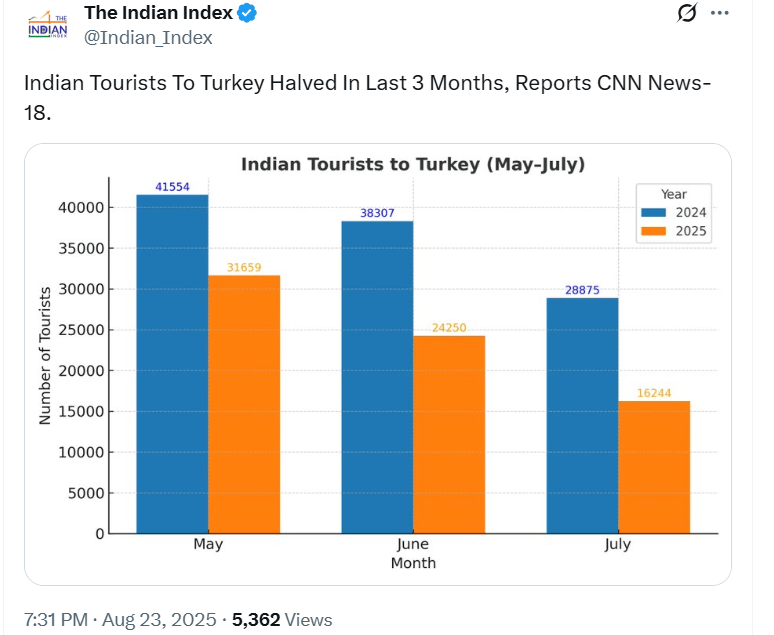

Given what has transpired, there has been a call for a boycott of all American products, including Domino’s Pizza, in India. Are these boycott calls material? Look at what happened to the number of Indian tourists visiting Turkey after the public became aware that Turkey helped Pakistan with drones during the recent war, and there was a call for a boycott of Turkey.

Now, there will not be a 100% boycott, but there is a good likelihood that DPZ’s India master franchisee’s sales will be impacted, thereby impacting DPZ’s sales over the next few quarters. Jubiliant Foodworks, DPZ’s master franchisee in India, accounts for 15% of DPZ’s international stores. International accounts for 7% of DPZ’s revenues.

Note

DPZ’s pizza prices in India are similar to those in the US.

Any meaningful impact on Jubiliant would impact DPZ’s gross margins and EPS. It is hard to guess how much, but all it takes is a slight earnings miss and negative commentary for the stock to tank.

Verdict: Based on what I have discussed, I expect DPZ to underperform over the next two to three quarters. Until next time, have fun!!!