- The Orca Fin

- Posts

- Truist Being True?

Truist Being True?

A look at TFC's recent jugglery.

Over a good part of this year - wherever I look - there have been layoffs, restructuring, and programs initiated for operational efficiency. And these are not just some random small companies, it is across the board. All of these news headlines have left me wondering; Either corporate America has become really smart and reacting proactively or the economy is not doing so well after all. Which is it? Please don’t point to the stock market and the government data. The government data over the years has become what they want it to be and the stock market isn’t the economy.

The other thing that caught people’s attention this week was all the talk about the USDJPY carry trade and its impact on the global financial markets. It is understandable why the Bank of Japan would want to depreciate the Yen to devalue the bloated debt away and prop up a “dead man walking” economy. However, there are a few things that people fail to take cognizance of. Central banks care a lot about the rate of change, i.e. the velocity of the move. Fast moves in the currency world can be destabilizing. Hence, the Bank of Japan intervened to stop the rapid depreciation of the Yen. Also, such moves are coordinated. Janet Yellen was at the G-20 finance ministers’ meeting in Brazil between July 24 and July 27. On the 27th - while the world was discussing the Paris Olympics opening ceremony - she made a statement on the sidelines of the conference. She said (paraphrased), “Japan briefed me about the 2022 FX intervention and the current one which started on July 19.”

The mini carnage on Monday caused many pundits and vaunted economists including market participants to call for emergency interest rate cuts. After the markets regained much of the losses over the week - even though it has been volatile - the calls for rate cuts stopped.

Given this economic backdrop and the possibility of the Federal Reserve embarking on rate cuts, I wondered how well the banks are positioned for an interest rate regime change in a weakening economy.

Gauging the Banks

There are the big boys like JPM, C, BAC, WFC, GS, etc., and then there are all the regionals. It is quite a vast universe and each has differences in their business models and assets they hold. For instance, GS has more trading and fee income, while the others rely more on interest income. So how does one do a like-for-like comparison? RoRWA (Return on Risk Weighted Assets).

RoRWA

While ROE (Return on Equity) and ROA (Return on Assets) are widely reported and quoted by the media and analysts, these well-known metrics fail to account for the leverage in a bank’s books and the risks associated with those assets. RoRWA solves this issue. RoRWA shows the real performance of a bank’s business independent of its capital structure.

Note

RoRWA = net income / risk-weighted assets

Sometimes bank analysts will use net income before taxes and exceptional items to account for differences in tax liabilities in various jurisdictions and ignore the one-off items to do a like-for-like comparison. This is what I did with the big boys first.

RoRWA for Select Major and Regional Banks

One can clearly see that JPM is doing well and the rest, mainly C, have issues. However, there are more metrics that need to be looked at, and further analysis needs to be done.

Truist Financial Corporation

While looking at the big boys helps and gives a reference point, they are systemically important banks and in times of crisis will be bailed out. The issues would show up in the regional banks and some could fold. So, I started going down the list and Truist Financial Corporation (TFC) caught my eye for the following reasons:

Its RoRWA before adjustments fell from 1.36% in 2022 to -0.34% in 2023. Hence, it was already not doing well and things went from bad to worse in 2023.

If not for the emergency Bank Term Funding Program (BTFP) unleashed in March 2023, TFC could possibly have faced larger issues.

It is a decent-sized bank with $555.3 billion in Assets and $434.4 billion in Risk Weighted Assets (RWA) for the period ending December 31, 2023.

It had reported major losses in Q4 2023 and again in Q2 2024.

Goes without saying that its P/E is negative, ROE turned negative, and the Cost of Liabilities shot up higher than ROA.

Intriguing indeed. So what happened from Q4 2023 till Q2 2024?

Analysing TFC

Before further getting into other ratios and financial statements, let’s get the fundamentals of what happened out of the way.

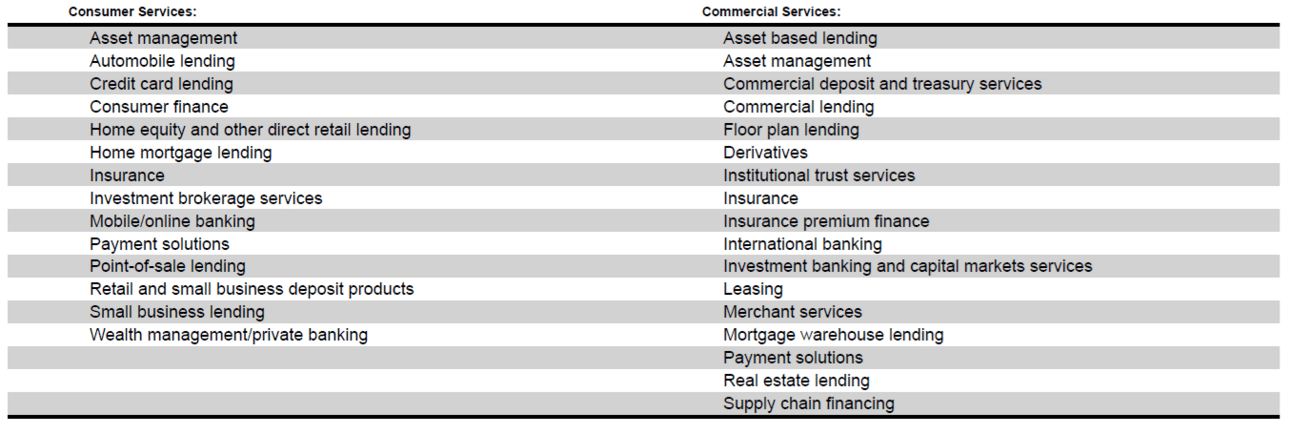

TFC is a Bank Holding Company with Truist Bank being its largest subsidiary. Apart from core banking offerings, it is also involved in other services.

TFC Services

While TFC has a higher concentration from the South East and Mid-West, it does have a presence in large markets in the North East.

TFC Markets

In 2023 TFC initiated a restructuring and operational efficiency program. It involved realigning business units and selling off business units among other things.

As part of the restructuring exercise, it sold one of its subsidiaries, Truist Insurance Holdings, LLC (TIH). Here are the highlights of the deal. (Source: 2023 10K PDF page 113).

On April 3, 2023, the Company completed its sale of a 20% stake of the common equity in TIH, which was previously wholly owned by Truist, to an investor group led by Stone Point Capital, LLC for $1.9 billion, with the proceeds, net of tax, recognized as an increase to shareholders’ equity. In connection with the transaction, the noncontrolling interest holder received profits interest representing 3.75% coverage on TIH’s fully diluted equity value at transaction close, and certain consent and exit rights commensurate with a noncontrolling investor. Including these profits interests, the controlling interest holder is allocated approximately 23% of TIH pretax net income.

On February 20, 2024, the Company entered into an agreement to sell the remaining 80% stake of the common equity in TIH to an investor group led by Stone Point Capital LLC for a purchase price that implies an enterprise value for TIH of $15.5 billion, and is expected to result in cash proceeds to Truist of approximately $10.1 billion after-tax, reflecting certain closing adjustments for cash, debt and debt-like items, including the settlement of certain previously granted TIH awards, working capital, transaction expenses and an investor return amount associated with the originally sold 20% stake.

The transaction improves Truist’s relative capital position and allows Truist to maintain strategic flexibility.

While the TIH transaction was used to improve its capital position, TFC took a huge goodwill charge of $6.1 billion in Q4 2023. This was the primary reason for the major loss in Q4 2023. (Source: 2023 10K PDF page 126).

The Company performed quantitative goodwill impairment analyses for its CB&W, C&CB, and IH reporting units as of October 1, 2023. Based on the results of the impairment analyses, the Company concluded that the carrying values of the CB&W and C&CB reporting units exceed their respective fair values, resulting in a non-cash, non-tax-deductible goodwill impairment charge of $6.1 billion for the year ended December 31, 2023.

Note

Bank managements have leeway on certain items and use their best judgment to resolve issues. The main accounting items one should investigate are:

Restructuring Charges

Level 3 Assets

Deferred Taxes

Provisions

Goodwill

Unusual items

It is always recommended to analyze financial statements in conjunction with the footnotes. The footnotes should have an explanation for these items. If the explanation is unclear, become even more skeptical.

In Q2 2024, TFC made another major move after the TIH transaction was completed. TFC repositioned its balance sheet by selling lower-yielding MBS (mortgage-backed securities) and investing all proceeds in shorter-duration investment securities. Apart from the losses emanating from these transactions, it took a huge charge of $6.7 billion. (Source: Q2 2024 10Q PDF pages 58 and 63).

Noninterest income was down $6.6 billion compared to the second quarter of 2023 primarily due to $6.7 billion of securities losses resulting from the balance sheet repositioning and lower other income, partially offset by higher investment banking and trading income and wealth management income.

Following the sale of TIH, which resulted in after-tax cash proceeds to Truist of approximately $10.1 billion, Truist executed a strategic balance sheet repositioning of a portion of its AFS investment securities portfolio by selling $27.7 billion of lower-yielding investment securities, resulting in an after-tax loss of $5.1 billion in the second quarter of 2024. The investment securities that were sold had a book value of $34.4 billion and a weighted average book yield of 2.80% for the remainder of 2024 including the impact of hedges and based on the Federal Funds futures curve at the time. Including the tax benefit, the repositioning generated $29.3 billion available for reinvestment.

Truist invested approximately $18.7 billion of the $39.4 billion available, including the $10.1 billion after-tax proceeds from the sale of TIH, in shorter duration investment securities yielding 5.27%. The remaining $20.7 billion was invested in cash. The blended reinvestment rate on the new investment securities purchased and cash is 5.22% for the remainder of 2024 including the impact of hedges and based on the Federal Funds futures curve at the time.

Note

It was not just TFC but others like PNC who went on a balance sheet repositioning exercise in Q2 2024. Is this a sign of no rate cuts in 2024? Just a thought. But it sure seems so.

That is some addition to the cash buffer. What does TFC know that we don’t?

99.6% of TFC’s securities portfolio is in US Treasury, GSE, and Agency MBS. The majority of which is in Agency MBS. If the Commercial Real Estate or Housing markets face stress, watch out.

However, do remember, the Federal Reserve is still playing games in the MBS market.

Adjusted Income Statement

Now that we have the background of the actions taken by TFC over the last few quarters, let us adjust the Income Statement. The purpose of this exercise is to figure out the true state of TFC’s operations adjusted for non-operational and one-time items. I would slice and dice it based on the footnotes, however, TFC provides this information in its quarterly presentation. Obviously, one would have to verify it against the information in the footnotes.

Note

Refer to TFC’s investor relations website for all 10K, 10Q, and quarterly presentations.

Most of what follows would be non-GAAP. However, this needs to be done while analyzing any bank.

TFC - Non-GAAP Net Income Reconciliation

As discussed earlier, the one-time items have been adjusted and if it were not for them, TFC would have reported profits. However, despite all the restructuring, earnings continue to fall and TFC’s guidance for 2024 is for flat to lower growth.

Using the “Diluted EPS from continuing operations - adjusted” of 1.72 for the first six months of 2024, we can assume the full-year EPS to be 3.44 (1.72*2). More on this later when we get to the valuation part.

Adjusted RoRWA

TTM adjusted net income = 1,235 + 1,216 + 1,094 + 1,071 = 4,616

RWA = 412,406

Adjusted RoRWA = 4,616 / 412,406 = 1.12%. We will use this later in the valuation section.

Net Interest Margin After Risk Costs

Note

Net Interest Margin After Risk Costs = Net Interest Margin - Net Charge-Offs

This ratio tells us how many defaults - in a stress scenario - the banks can handle till their Net Income becomes negative, thereby putting the bank’s solvency into question.

TFC provides this information in its quarterly earnings presentation. The rule of thumb is that a bank’s Net Interest Margin after Risk Costs should be more than 1.5%.

TFC - NIM after Risk Costs

Essentially, TFC’s net charge-offs have to increase 5x for it to start hurting in a bad way, however, a 3x increase would put TFC in a stressed situation. This goes back to what we discussed earlier; keep an eye on TFC’s Agency MBS portfolio. However, the portfolio repositioning has given them more than enough cushion against a short-term run on deposits or distress in their securities portfolio.

Given that, there is another income source that TFC has to cover part of its expenses.

Noninterest Income

Noninterest income generally comes from credit and services fees and trading fees. For TFC the trading fees or income is small compared to other income. Currently, TFC’s net interest income and noninterest income combined cover the noninterest expense, however, the noninterest income doesn’t cover the noninterest expenses. This could become a major risk factor for TFC if there is a stress scenario in the near future. Hence, TFC needs to bolster its noninterest business. The management is focusing on that. (Source: 2023 10K PDF page 53).

Noninterest income is a significant contributor to Truist’s financial results. Management focuses on diversifying its sources of revenue to reduce Truist’s reliance on traditional spread-based interest income, as certain fee-based activities are a relatively stable revenue source during periods of changing interest rates.

Note

There are two ratios commonly analyzed and referred to by banking analysts to measure the efficiency of the bank and how much fee income is important to it.

Efficiency Ratio - Also known as the cost-to-income ratio. Generally, it should be between 50% to 60%.

Fee Income Ratio - How much portion of fee income is part of the bank’s income.

As we shall see below, the ratios based on GAAP numbers are out of whack due to all the one-time charges, however, they seem fine on an adjusted basis.

TFC - Important Ratios

Capital Adequacy

A common conundrum for analysts and regulators is how much the CET1 (Common Equity Tier 1) ratio is adequate and how much the leverage ratio is adequate for a bank. (Source for this section: Q2 2024 10Q PDF page 79).

Which Capital Ratio to Fix?

If RWA/Total Assets > 33%, fix the CET1 ratio.

If RWA/Total Assets < 33%, fix the leverage ratio.

For TFC, RWA/Total Assets = 79.3%. Hence, the CET1 ratio needs to be enhanced.

Guess what TFC has been doing? Fixing its CET1 ratio. TFC’s CET1 ratio increased by 150 basis points QoQ to 11.6%.

Now what is the correct CET1 ratio for TFC? That is between the regulators and TFC. FRB (Board of Governors of the Federal Reserve System) has approved the capital plan submitted by TFC in April 2024 and notified TFC in July 2024 that TFC is no longer required to receive FRB’s approval to make capital distributions.

Truist did not repurchase any shares in the second quarter of 2024. Truist's board of directors has authorized a $5 billion share repurchase program beginning in the third quarter of 2024 through 2026 as part of the Company's overall capital distribution strategy. Truist declared common dividends of $0.52 per share during the second quarter of 2024 and maintained its current quarterly common stock dividend in the third quarter of 2024.

Valuation

Consider the following table:

TFC - Select Valuation Metrics

Note

For Equity and Tangible Equity refer to Q2 2024 Earnings Presentation (PDF page 28).

Shareholder’s Equity per Share = 42.71

Tangible Shareholder’s Equity per Share = 28.91

TFC’s management uses #1#b for making its decisions as it removes intangible assets and net deferred taxes.

Attributable Forward P/E is my estimation based on the following factors:

Given TFC’s risk profile and poor adjusted RoRWA of 1.12%;

I couldn’t bring myself around to give TFC a P/E higher than WFC, C, or BAC.

Generally, for solid banks, the Market Cap/Equity is higher than 100%. However, since TFC’s management uses Tangible Equity, Tangible Shareholder’s Equity per Share is more meaningful here.

Given these facts, TFC is currently overvalued until it fixes its RoRWA and brings it above 2%, or simplistically, it needs to fix its earnings and growth profiles.

Until next time. Have fun.

Disclosures: Here are our internal governance rules to ensure no conflict of interest. For companies we write about:

No existing position.

If we have an existing position, we exit and wait seven days before publishing.

Wait seven days after publishing before initiating any new position.