- The Orca Fin

- Posts

- Snowflake's Winter

Snowflake's Winter

What is behind Snowflake's recent capital raise?

On September 23, 2024, Snowflake (SNOW) an AI Data Cloud Company announced via a press release that it intends to raise $2.0 billion via Convertible Senior Notes with a provision to raise an additional $300 million as part of the offering. The markets didn’t like the news and the stock was down more than 4% at one point after hours. The stock recovered and closed 0.51% down during regular trading hours on September 24, 2024.

As I looked at the price action after hours on the 23rd, I decided to peek at SNOW’s financial statements. The first thing that stood out was that SNOW has $3.2 billion in cash and short-term investments in its balance sheet and has zero debt. So what are they planning to do with this new cash?

Snowflake expects to use the net proceeds from the offering to pay the cost of the capped call transactions described below, to repurchase up to $575.0 million of shares of its common stock from purchasers of the notes in the offering in privately negotiated transactions as described below and for general corporate purposes, which may include other repurchases of its common stock from time to time under its existing or any future stock repurchase program, as well as acquisitions or strategic investments in complementary businesses or technologies, although Snowflake does not currently have any plans for any such acquisitions or investments.

Essentially, they want to buy back shares and spend on general corporate purposes. No wonder the market didn’t like the press release as it lacked details about any meaningful and material initiatives that would enhance the company’s product offerings.

Intrigued, I looked at SNOW’s Income Statement and my jaw hit the floor. Why is a loss-making company buying back shares?

Income Statement Analysis

Note

Snow’s Financial Year ends on January 31. For instance, SNOW is currently in FY 2025. The years mentioned in the tables are Financial Years and not Calendar Years.

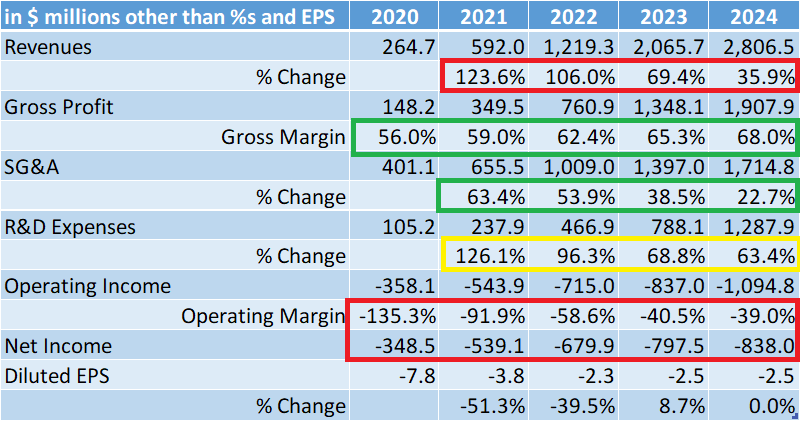

So, how is SNOW doing operationally? Here is a snapshot of SNOW’s income statement.

SOW- YoY Income Statement Analysis

Observations:

Revenue growth has slowed down materially.

Gross Margins are solid and increasing. This is great to see.

SG&A costs are increasing at a slower rate than revenue. Another positive. It shows that the management has control over these costs.

The faster growth in R&D expenses compared to revenue growth is concerning but expected for a software product company. As the company matures, the better way to monitor R&D expenses would be to measure it as a percentage of revenue and then compare that YoY.

A loss-making company with no operating profits? No wonder investors are not happy with SNOW spending cash on buybacks.

Quarterly Income Statement Analysis

Note

The percentage change in the table below is calculated sequentially QoQ.

SOW- QoQ Income Statement Analysis

Revenue growth sequentially is poor. Is the following the reason?

The substantial majority of our revenue was derived from existing customers under capacity arrangements, which represented approximately 98% of our revenue for each of the three and six months ended July 31, 2024 and 2023.

Refer to PDF page 50 of SNOW’s 10Q for Q2 FY2025

Essentially, SNOW has been unable to add new customers who have contributed meaningfully to their revenues over the last year and a half. Also, it seems that the usage of SNOW’s products has plateaued among its existing customers. Note that SNOW charges its customers based on usage. It is concerning indeed.

Diluted EPS has deteriorated and so has Operating Income. There are some serious issues with this company.

SNOW initiated a share buyback program of $2.0 billion in February 2023. The stock market was none too happy about it and SNOW’s stock has been in a bear market since. As of July 31, 2024, $491.9 million remains in the program initiated in 2023.

In August 2024, SNOW approved an additional $2.5 billion in share repurchases. (Refer 10Q Q2 FY2025 PDF page 30). The investors couldn’t care less about it. They were not impressed. Why should they?

Maybe to address the market’s concerns about the increased outlay on share repurchases SNOW initiated this Senior Convertible Note offering as it would offset the share repurchase program to a certain extent. Even though there is an ongoing discussion about the Note offering being nondilutive, it is dilutive net-net. It just offsets some of what was already approved.

The stock repurchases will be effected as part of Snowflake’s stock repurchase program authorized by its board of directors in February 2023 and increased and extended in August 2024. Accordingly, the stock repurchases will reduce the approximately $2.55 billion remaining amount authorized and available under such stock repurchase program as of the date hereof. (Refer to SNOW’s press release)

And it gets worse.

SNOW - SBC Games

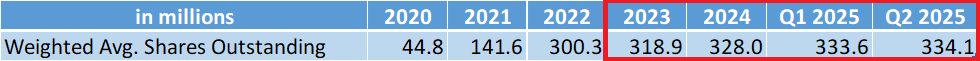

Wait a second. SNOW has been repurchasing shares since last year but the shares outstanding are still rising. What is going on here?

Cash Flow Statement Analysis

An unethical management trying to portray better Cash Flow from Operations (CFFO) would move regular expenses to the investing and financing sections of the Cash Flow Statement. One can argue that Free Cash Flow (FCF) solves most of this. Not really. FCF only addresses the CAPEX part of it as SNOW shows. (Refer to 10Q Q2 PDF page 44). What it doesn’t address is inordinately large Stock-Based Compensation (SBC).

Here is a snapshot of SNOW’s Operating Activities Section of the Cash Flow Statement.

SNOW - More SBC Games

SBC adjustment is causing SNOW to remain Cash from Operations positive. Now pay attention to the last column. See the huge dip in the Cash from Operations? Perversely, SNOW needs to increase its SBC. I am laughing here.

In all seriousness, I believe this is what is going on here. It is just a guess.

Hide the huge SBC by buying back shares.

Mask operational deterioration by keeping shares outstanding from exploding higher exponentially.

Optically this stinks to the high heaven. It portrays a management trying to enrich itself at the expense of the company’s shareholders.

But wait, since I spent some time reading the filings, here are a few findings.

Deteriorating Retained Earnings

And Uncle Buffett says in his letters…. BS Artist

Negative retained earnings are not always bad in and of itself. It needs to be seen in the context of why it is negative. In the case of SNOW, it means at some point in the future SNOW will run out of cash and need to raise more money for operations on top of the need to cover all the SBC. Do you hear air raid sirens?

Differential Disclosures

Differential disclosures are classified as a company saying something in one filing or press release and saying the opposite thing in another. SNOW gives out guidance, right? Now consider this.

We may not have visibility into our future financial position and results of operations.

Refer to PDF page 61 of SNOW’s 10Q for Q2 FY2025

Here is another case of differential disclosure.

We believe that our existing cash, cash equivalents, and short-term and long-term investments, as well as cash flows expected to be generated by our operations, will be sufficient to support our working capital and capital expenditure requirements, acquisitions, and strategic investments we may make from time to time, and repurchases of our common stock under our authorized stock repurchase program, for the next 12 months and beyond.

Refer to PDF page 54 of SNOW’s 10Q for Q2 FY2025

However, they go on to hedge that statement in the same paragraph. Contradiction in the same paragraph is not something I have seen in a while

We may, as a result of those arrangements or the general expansion of our business, be required to seek additional equity or debt financing.

Differential statements are a sign of a dishonest company and management.

Liability Exposure

We assume liability for data breaches, intellectual property infringement, and other claims, which exposes us to substantial potential liability.….. In addition, our customers or other business partners may attempt to claim indemnification even if we are not at fault, and defending against such claims may be time-consuming and expensive. There is no assurance that our applicable insurance coverage, if any, would cover, in whole or in part, any such liability or indemnity obligations.

Refer to PDF page 71 of SNOW’s 10Q for Q2 FY2025

Ardent followers of SNOW may remember the May 2024 security breach incident. Nothing much is said about that incident in the 10Q other than that some customers have filed lawsuits. You know where the exit doors are, right?

Customers

SNOW has 510 customers with product revenues of greater than $1 million. These customers account for 65% of the trailing twelve months’ revenues. (Refer to PDF page 50 of SNOW’s 10Q for Q2 FY2025). Now, why does a company with $37.96 billion in market capitalization have to break this down? Appreciate the detail, but:

Throwing peanuts from the peanut gallery.

Trolling aside, 93 and 36 of SNOW’s customers account for product revenue greater than $5 million and $10 million.

Warren Buffet

I remember seeing all the headlines about Warren Buffett investing in SNOW’s IPO in 2020. My first reaction was, “Who is advising him? If he wants to invest in the database market, he should just invest in Oracle. Oracle is the bossman of the database market.” In any event, Buffett sold his SNOW holdings in August. I guess he had enough of all the shenanigans.

Verdict

Do I even have to pass a verdict here? I will do it anyway. SNOW is dead money. The last time I passed such a verdict was on January 31, 2024. Guess who the company was? Boeing. Until next time. Have fun!

Disclosures: Here are our internal governance rules to ensure no conflict of interest. For companies we write about:

No existing position.

If we have an existing position, we exit and wait seven days before publishing.

Wait seven days after publishing before initiating any new position.