- The Orca Fin

- Posts

- "Chainsaw Mark" Zuckerburg

"Chainsaw Mark" Zuckerburg

Meta's Resurgence.

The Three Envelopes story is more a joke based on reality and plays out to the tee wherever one looks. So, what is the hubbub all about?

A new CEO walks into his new job and finds three envelopes left by the previous CEO on his desk with a note saying, “Open these if you run into serious trouble.”

Some time passes and the company is not performing as per his expectations, Wall Street is hammering the stock, so, he opens the first envelope. It reads, “Blame it on me.” He calls a press conference and explains that the previous guy left him a big mess, it would take some time to fix.

Despite his efforts, the company continues to underperform and the stock continues to sell off. So, he opens the second envelope. It reads, “Announce major restructuring.” As he slashed jobs, incorporated operational excellence programs, and cut costs, Wall Street rejoiced and egged him on like rabid fans from the bleachers. The stock goes on a massive bull run and creates ginormous wealth.

As the benefits roll over and the CEO has probably cut to the bone, the earnings eventually hit the ceiling. The CEO is distraught for having missed Wall Street’s expectations and watching the stock crash, he opens the third envelope. It reads, “Prepare three envelopes.”

I wouldn’t be of much use to CEOs with the first and the third envelopes, however, if you have no qualms about using some unethical sleight of hand, here are some tips.

Write down as much of the assets as you can. Just slash and burn the inventory, plant, and equipment values. Viola, you just took all the future expenses (depreciation) for those and dumped them below the Operating Income line.

Is amortization bothering you? Write down whatever intangible assets you can.

Say you are laying off 5,000 people, provision for 7,000 or even 10,000; whatever you can get away with. The extra provision will come in handy to boost earnings in the future. Just release back the extra provision whenever you need it.

Don’t look at me like I have two heads or something. I have not lost my marbles. Here is an example.

“Chainsaw Al” Dunlap

Yes, that is where the “Chainsaw” in the headline came from. So, Al was the restructuring rockstar of the ‘80s and the ‘90s. Since 1983, Al had six successful stints as CEO—turning around failing companies and generating huge shareholder returns using the techniques I highlighted among other “stuff”.

The last company Al successfully restructured was Scott Paper. Al increased the company’s market value by 230 percent to $6.3 billion and then sold it to Kimberly Clark for $9.4 billion. Rockstar CEO indeed.

One fine day in July 1996, Sunbeam announced Dunlap was taking over as CEO. The stock was trading around 12.50, jumped 60%. By Q1 1998 the stock was trading around 53—generating immense wealth for shareholders and Dunlap. Then the proverbial—you know what—hit the fan. Sunbeam reported a loss for Q1 and the stock tanked more than 25%.

There were already rumblings of wrongdoing and unethical practices doing the rounds on the edges—the media piled on. The board announced an investigation, Sunbeam had to restate six-quarters of earnings, wiping out almost all of 1997’s profits, and Dunlap was fired. Sunbeam eventually ended up filing for bankruptcy.

Tip

Could a retail investor have caught that Sunbeam was a fraud? Yes. Always run the Beneish M-Score on any company excluding banks before investing. If a company fails the test, walk away. As a retail investor, you have better things to do in life than try to figure out whether a company is a fraud or not.

Note the two examples Prof. Beneish has listed. Sunbeam and Tesla. However, what made the M-Score famous was Enron.

History is cool. Isn’t it?

Meta

This blog didn’t exist in 2022 when Meta started its restructuring program. However, I did write about Meta on July 26, 2024. The headline? Meta’s Comeback. I even used the phrase: roaring buy. I would request you to read it as there is informative stuff in there that I won’t repeat here.

Long story short, Meta’s growth was plateauing in 2022, and it announced a major restructuring in Q3 2022. What better time to restructure than when the economic outlook is gloomy? As luck would have it, sentiment turned, and the markets started rebounding in 2023—pulling Meta along with it.

2022 Restructuring

Starting in the third quarter of 2022, we began a series of cost management initiatives including facilities consolidation, a layoff of approximately 11,000 employees, and a pivot in our data center strategy, which resulted in total restructuring charges of $4.61 billion in 2022.

Source: 2022 10K PDF Page 55

Break down of restructuring charges taken:

Source: 2022 10K - Note 3

In my previous article, I questioned Big Tech’s fun and games with the depreciation schedule. Technological innovation was the rationale for elongating the depreciation schedule for server and networking equipment. But look what Meta dumped into the restructuring charges. One can’t have it both ways, i.e., get the benefit of a longer depreciation schedule and then turn around and impair the same stuff below the operating income line.

Meta is a cash-rich company that doesn’t need to play games with layoff expenses. From 2022 onwards, Meta has been clearing out the provisions related to severance within a few quarters.

2023 Restructuring and Beyond

In 2023 Meta took a $2,255 million restructuring charge for facilities consolidation and severance-related expenses. There was no kitchen sinking of data center assets.

In 2024, Meta took a $389 million restructuring charge for facilities consolidation.

Assigning the moniker “Chainsaw” to Mark is actually an insult to the legacy of Dunlap. However, it seemed apt in the context of the recent announcement that Meta is laying off 5% of its workforce on January 14. The stock has gone straight up since then—from ~600 to 736 as of Friday.

From Wall Street’s perspective, what is not to love? A leaner company with all the cash to invest in AI and the potential to generate ginormous returns. There was a reason I highlighted The Three Envelopes story. While that was a dramatic portrayal, this is how it generally plays out on a regular basis.

Other Observations

Effective Tax Rate

Mostly overlooked, the effective tax rate is important as it impacts net income and eventually the EPS not considering buybacks or dilutions. Meta’s effective tax rate was 19%, 18%, and 12% for 2022, 2023, and 2024 respectively.

Our effective tax rate in 2024 decreased compared to 2023, primarily due to excess tax benefits recognized from share-based compensation and an increase in research tax credits.

Source: 2024 10K - PDF Page 76

Worth keeping an eye on. Meta explains the variables and what to expect for 2025 on the referred page in the 10K. Check it out, if interested.

New Data Point in 10K

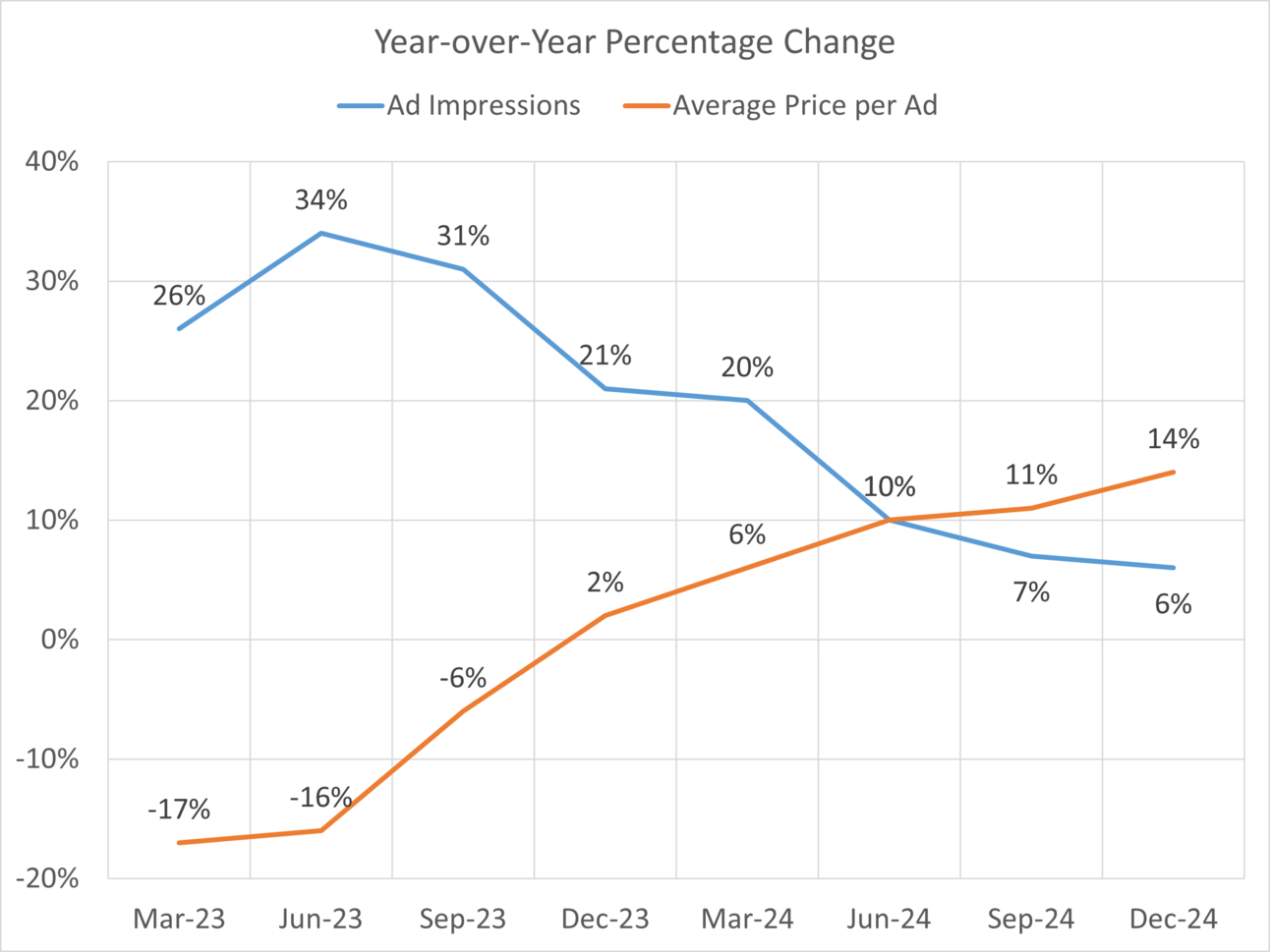

I always find it interesting when a company decides to include a new Key Metric or highlight new data points. There has to be a reason for them to go out of their way to do that. In the 2024 10K Meta started highlighting the Year-over-Year percentage change in “Ad Impressions” and “Average Price per Ad”.

Source: 2024 10K - PDF Pages 67-68

Seems like a classic Demand Curve situation. While one may rejoice at the recovery in pricing, the bigger concern here is the falling growth rate in Ad Impressions—that too during the holiday season. If anybody was looking for a weakness in Meta’s business, Meta gave it to you on a platter.

Looking Ahead

I am not sold on Meta’s claim of the benefits of AI in displaying targeted Ads and generating greater value. Never used Facebook regularly. Decided to go take a peek. Created an account, looked around for 5 mins, and then, “How do I close the account?”. It took me 10 minutes to figure out how to do it. So, anecdotally, their user numbers are pretty much questionable even if they claim to have the greatest algorithms to calculate that. Also, the less I say about Threads the better.

It’s been a great run for my early subscribers. Couldn’t have knocked it out of the park any better. Time to take profits.

While I may have caught people’s attention due to my May 2024 SMCI article, you can judge that I am not some shorty pants running around with my hair on fire.

Random Thoughts

Elon claimed that 150-year-olds are getting social security benefits and made some bombastic and derogatory claims. When he was making those claims, I wanted to ask him, “Dude, did your kiddie experts bother to look that the DOB of all those 150-year-olds is May 20, 1875?” Obviously, the world-class tech experts of DOGE don’t know what epoch in computing is and specifically, how it impacted and continues to impact Mainframe systems.

Now there are nuances and caveats to it, but looking in from the outside it is evident that the SSA is using the Metre Convention signed date as the epoch. You would be surprised how commonly Beethoven’s birthdate is used as the epoch. Whatever the case, there are various reasons the DOB could be missing or wrongly entered and it would get stored as the epoch date in VSAM. Then there is COBOL and the copybook.

I can understand that the younger generation may not be aware of all the technical details of legacy systems, but what shocked me was that they were given root access across the board. Apart from all the Federal law violations, giving these guys root access is beyond dangerous. All I can request you to do is PRAY.

Was wondering why DeepSeek rhymes with Deep-Six. Quite a coincidence or the person who came up with the name has a corny dark sense of humor. Ok, Ok!!! I am done for today. I will go bore someone else now.

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.